I am James Barnick, Jr. and I manage the retread shops for McCoy Truck Tire. I had recently started working with the sales staff as I realized that the BASys manufacturing system captures a lot of data that would be useful in helping our customers make better decisions. I helped a few customers evaluate the comparative retreadability of various brands. The value of this information was high and so I informed all the salesmen that I was available to help them in a similar way.

At this point, Mark Kraemer from our French Camp store asked me to help him with a particular problem that had arisen for one of his customers. The number of retreadable casings they generated was diminishing and they were having problems keeping their inventory up to their desired levels. Mark had a hunch that the problem lay in the fact that the customer had purchased many new trucks in the 2012-13 range to comply with environmental regulations and these tires were now getting older than fleet specifications found acceptable. The customer had set a rule allowed a maximum age of five years at the time of retread. This was to prevent problems due to tires getting too old and becoming unreliable. They had retreaded older tires before and were dissatisfied with the number of road calls that these older tires had been generating. This decision had very good results- road calls became a rare event, dropping to about two a month as compared with the average of three a week with the more liberal casing program. (I, of course, believe that our higher quality of craftsmanship also had a positive effect, a view that the out-of-service records would justify.) The idea of solving the problem by dropping the standards of the casings that would be retreaded was a plan that the customer was not willing to consider. Mark also concurred in this decision. This was because he inspected every tire that left the fleet, so he was very familiar with the condition of the customer’s tires and requirements.

The customer was a regional wholesale distributor and needed to meet a schedule that could not afford many delays. Fortunately, the customer used major brand tires and had good maintenance and drivers. We needed to help him find a way to generate the necessary casings in a way that would preserve the reliability. Mark asked me to help him by generating the information that might help his customer make a good decision.

What is the cause of the problem?

First I had to find the cause of the problem. Mark and the customer had concluded that the problem was the result of buying so many trucks at once, and they had some information that pointed at this. Looking back at the records, they had determined that in 2016 and 2017 about 15% of all the customer’s tires that were removed from service were scrapped due to age. In 2018 this number rose to about 30%. This pushed the recovery rate of tires from about 70% to about 50%. Almost half of the customer’s tires were being scrapped, and hence the shortage of casings.

While this seems to be the obvious answer, there still was a small portion of the change that was unaccounted for. In consultation I discovered that there was another change that the fleet was making with their trailers, and by allowing for this effect I was able to say with certainty that the casing age problem was the result of the truck purchase and no other effects were important.

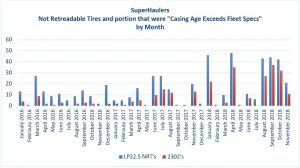

I then pulled off some reports from the BASys system to illustrate the trend in the customer’s casing losses.

You will notice particularly that the number of tires lost grows significantly in 2018. As the year progresses the losses accumulate causing the shortage as the customer’s supply dwindled.

Potential Solutions

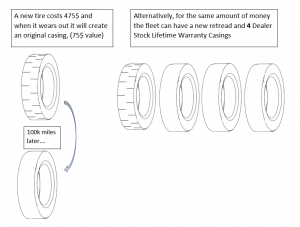

We started then to discuss potential solutions. I seemed to me that they would need to replace these with either new tires or with cap/casing purchases. My thinking was that the cap/casing purchase was a ‘no-brainer.’ I saw clear cost advantage as irrefutable.

Mark objected that this is not a complete answer because it does not take into account the cost-per-mile which is a better way to measure the value of a tire’s performance. A good average for this particular fleet is 150,000 miles on the new drive tire and 85,000 miles on the retread.

New Tire

Original tread 3.167 $/1k miles

First retread 2.118 $/1k miles Cap/Casing 3.000 $/1k miles

Total Drive 2.787 $/1k miles 3.000 $/1k miles

The case, then is clear. The new tire program is less expensive by 7.6% and so should be the decision made.

I had a sleepless night over this. I was sure that the retreaded tire was the best solution. I needed to present what I had found to my salesman and get his take on this.

He didn’t object to my findings. He needed to present the new tire replacement program as the lowest cost solution. But he made a very important point. The new tire solution is the best except for the fact that it does not solve the problem. Remember that the problem is not, ‘How do I get the lowest cost-per-mile?’; it is, ‘what is the best way to replenish my inventory?’

If you buy the new tires, you will spend 475.00 each now, but will not have a casing for retreading for another two years. Needing to replace about 24 tires a month means that the customer is faced with spending over $12,000 on new drive tires additionally each month for the next two years. With the cap/casing purchases he will accomplish the same result with an additional monthly expense of $6,200. The implications are that by the time the problem is effectively addressed he will have spent nearly $300,000 over two years, with a projected net savings of $20,000! The residual value of the tire would only be realized as the tires wore out, taking even more time before the benefits were captured.

It seems that this question is a lot more complicated than it first appears. When I asked Mark about how he would go about this he gave me a list of considerations that affect the tire purchasing decision. They are as follows:

- Cost per mile: This number helps to evaluate the relative value of different products. A more expensive tire needs to provide longer service in order to justify the expense.

- Fuel efficiency: Tires are an important consideration as they can have a significant impact on the customer’s largest cost, fuel.

- Risk exposure from damage: For some customers, they have a lot of ruined tires due to their running conditions- others seldom have damaged tires and few flats. The scrap tire records can tell you how much you lost from these operational costs.

- Frequency and expense of road calls: The costs and delays associated with road service can become very expensive. Every customer has a different level of tolerance for these events and this effects the type of tire that is suitable.

- Application issues: This includes the ability of the chosen product to withstand some of the conditions that are specific to that particular customer’s operation. Irregular wear and rock drilling are two common issues that influence a customer’s tire decisions. The amount of traction required for the drive tires is another major consideration.

- Labor costs: Any attention that the customer must give to the tire is also a consideration. Faster wearing tires must be replaced more often. Tires that do not resist irregular well must be rotated or dismounted and placed on trailer to be run out. The cost of this labor influences the decision as well.

- Fleet Capitalization: The cost of tires is considerable. The investment is recovered as the tire is used to generate income by hauling freight. This takes time for the value to be realized.

I learned a lot from Mark on this fleet and look forward to sharing other things I learn from him about tire program consultation with web visitors in the future.

Thanks for Reading!